1,000,000 Homes: A New National Housing Infrastructure | Part 2

Why Urban and Rural Areas Stay Underbuilt— and a Radical + Practical System Scale Homeownership For 1,000,000 Families.

[10 Minute Read]

Call To Action Upfront

1 - Read Part 1 - Investment Executive Brief: 1,000,000 Homes: A $250M–$1B Raise to Establish a $350B National Housing Infrastructure

2 - Download the National Housing Infrastructure Investment 11 Page Deck

3 - Book a 20-minute call with Daniel (Daniel@1M.Homes)

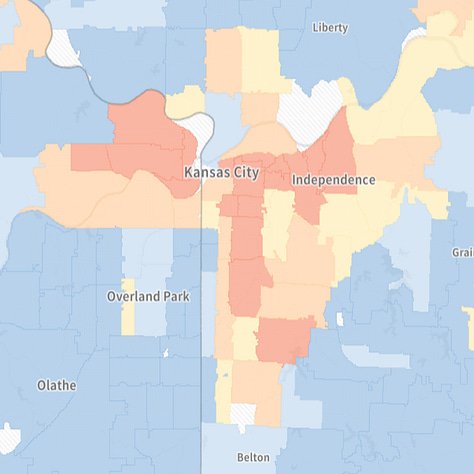

4 - See Working Housing Scorecards

(don’t see your city? Reach out and we’ll build one with your team)

Thanks for reading OneMillion.Homes! This post is public so feel free to share it.

Who this is for — What you should get

Investors: The $350B infrastructure play hiding in plain sight—measurable throughput.

Philanthropy & CDFIs: A systems lever that multiplies impact beyond pilots.

City leaders: How to buy capacity (not one-off projects) where production never starts.

Builders & trades: A predictable pipeline with standards, schedules, and on-time pay.

Employers & anchors: Workforce homes near job centers to hire and retain talent.

Residents & neighborhood leaders: Homes you can buy, plus careers that keep wealth local.

Hyperlinked Table Of Contents:

The “90% Rule”: what everyone knows vs. what no one says

Everyone knows there’s a housing shortage.

The missing piece is where the shortage lives—and why it’s rare to see housing production here.

90% of America’s shortage sits in only US 212 metros.

~90% of buyer demand concentrates in the urban core of those us Metros (the “urban donut”).

Yet production flows to the edges in your suburban communities at scale; the core doesn’t produce more than a few luxury of deeply subsidized homes —year after year.

Why? Not because people won’t buy.

Because there’s no infrastructure to de-risk production in those places.

Housing Crisis = The Urban Core Fragmentation Tax:

7 Factors That Actually Blocks Production

Too many moving parts. Building one single-family home takes 400+ steps to coordinate. Building several at once takes 500+. Scale that: 20 builders × 10 homes each = 200 homes = 80,000–100,000 steps. One missed handoff stalls the line.

Every plan is different. New drawings, specs, lenders, subs, inspections—every time. Lessons don’t compound, so costs don’t fall and speed doesn’t rise.

Every site is unique. Lot widths, utilities, soils, setbacks, overlays—each adds friction. Infill isn’t copy-paste without a coordinating system.

Chronic under-capacity. Small builders and trades are maxed out. To get the best crews, you pay a premium—which kills affordability in the urban core and pushes production to luxury one-offs.

Permitting isn’t built for throughput. City offices are understaffed and run legacy processes. Each plan set restarts the learning curve; reviews stretch from weeks to quarters.

Fragmented financing flow. Traditional draws don’t cover mobilization or early materials. Cash gaps slow starts; schedules slip; carry costs rise.

7. The Overwhelming NOISE of Well-Meaning Intermediaries Using The Wrong Business Models.

From city to city, this is the hardest barrier in housing production: defaulting to the wrong sources. Cities keep outsourcing to “safe” players—long-tenured CDFIs, civic coalitions, legacy developers—who sound right on paper but deliver studies and panels instead of homes.

Promises of homeownership slide into rentals and tiny pilots; the neighborhoods don’t change. Microphone ≠ machinery: authority on stage without a production system on the ground only reinforces the myth that “these areas can’t work.”

Root cause: wrong business model—no local production infrastructure—so big-institution playbooks break every time. Bottom line: judge success by throughput (homes delivered, monthly) and capacity built (local crews trained, systems installed), not headlines.

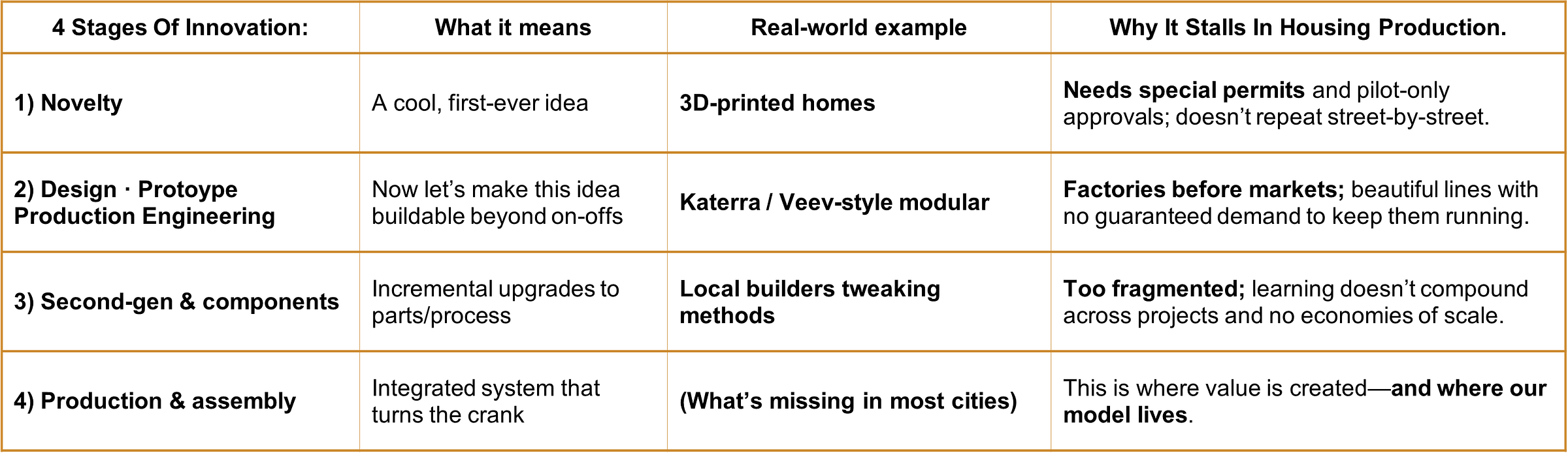

Housing Innovation In Real Places

Invention is coming up with new ideas;

Innovation is turning ideas into products and services that actually reach people.”

Dan Breznitz, Innovation in Real Places - Advisor To OneMillion.Homes

If we apply that lens to housing, the difference is stark. Most “innovation” stops at ideas and pilots;

Real progress happens when a system reliably produces homes. Here’s how innovation is affected through the lenses of housing.

Shift From Novelty → To Production and Assembly

Stages 1–3 chase headlines or pilots; they don’t overcome the Fragmentation Tax (permits, financing, suppliers, crews, inspections all rebooting each time).

Real value happens at Stage 4—where inputs, schedules, and teams are synchronized so output is predictable.

Radical + Practical Innovation -

A New Housing Infrastructure

We traveled the country looking for “the model.”

Everywhere, the magnitude of the solution failed to match the magnitude of the demand.

So we built something radical:

A platform from day one, sized to national strategy of 1,000,000+ Homes.

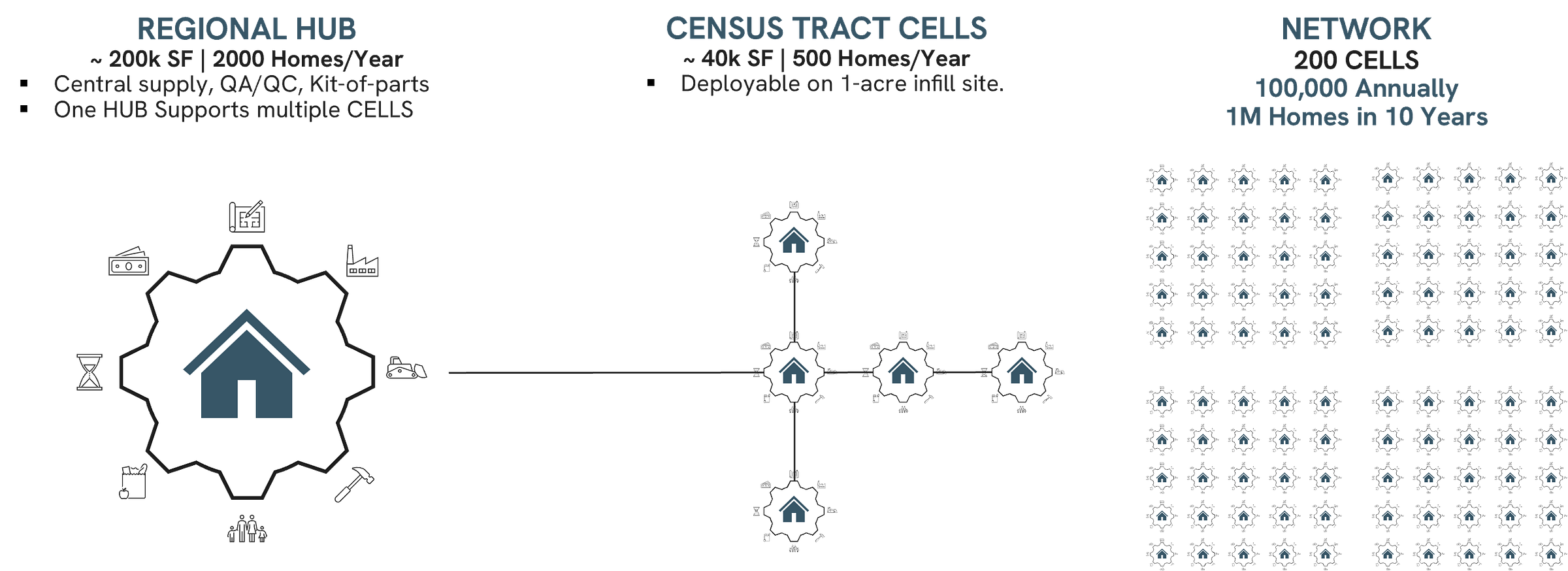

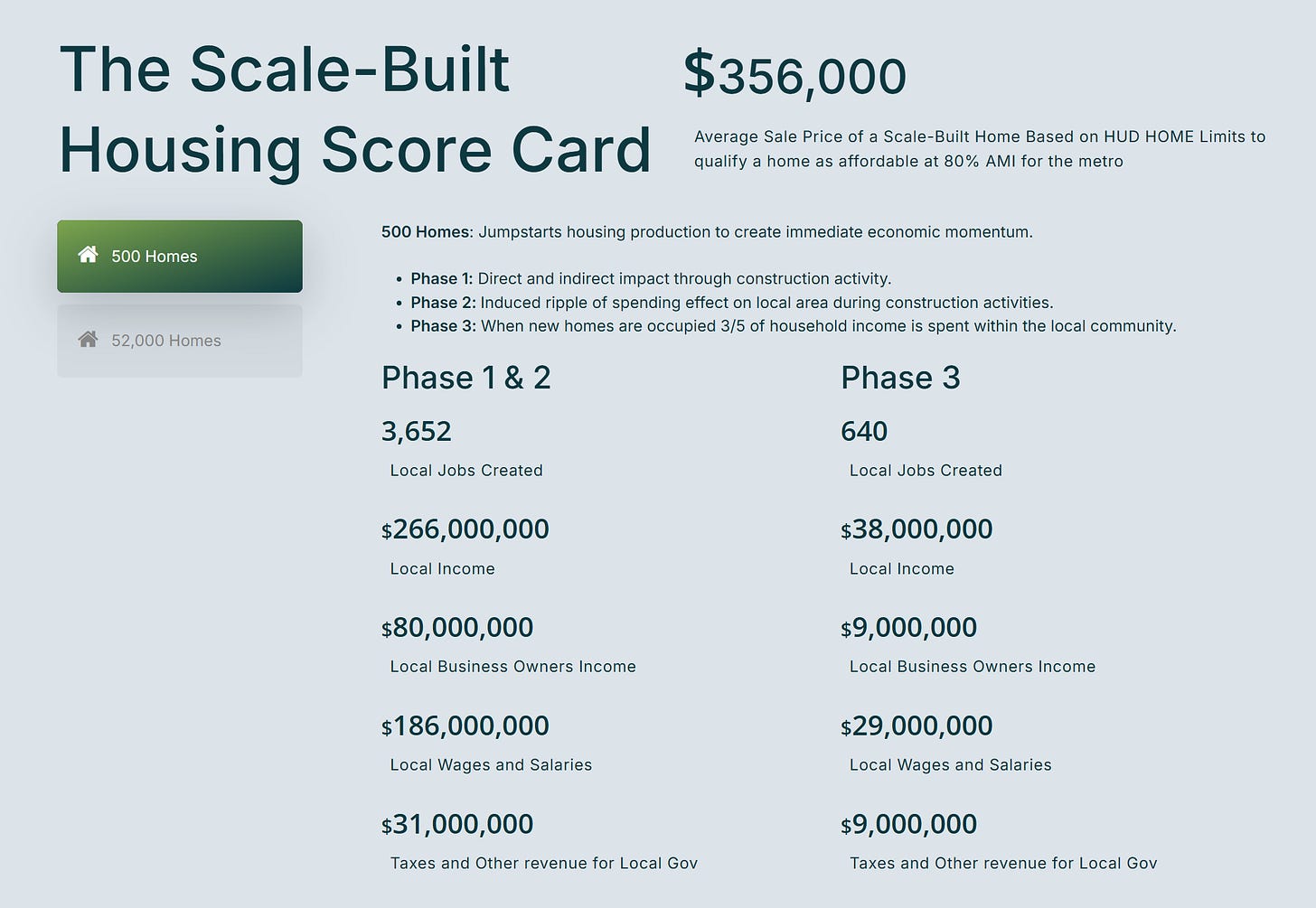

We call this platform Scale-Built Housing™: a new category of housing delivery for cities that need capacity, investors who need throughput, and operators who can execute now.

Throughput you can underwrite—in the very places everyone calls “high-risk.”

And we kept it practical:

It adapts to the capacity of on-the-ground operators who can execute now.

One production-and-assembly system, plug-and-play across cities—so a builder in Kansas City can access the same standards, economies of scale, suppliers, and speed as a builder in Chicago or Philadelphia. One process improvement in Oklahoma City is updated in Chattanooga.

Innovation Platform: Bilt-Blocks OS™ (The Operating System)

Collapsing thousands of fragmented steps into standardizes design, permitting flow, financing, supplier lists, field sequencing, and buyer pipeline—so each batch starts faster, costs less, and delivers more.

Municipality-as-Client

(the demand contract)

Cities don’t buy projects — they buy capacity.

Most “housing innovations” start by designing speculative products and factories without locked-in buyers—factories without markets.

We do the opposite: our primary clients are municipalities with publicly stated housing needs, so demand isn’t speculative—it’s an input to the engine.

We formalize that with a simple, staged contract so it’s not overwhelming on day one, and it scales predictably over ten years.

What the city commits to:

Throughput target: greenlight ≥ 5,000 homes over 10 years (capacity contract; cancellable for cause, ramped by milestone gates).

Fast path permits: co-created permit templates so approvals move in weeks, not months.

Site pipeline: selection and assembly of sites through city or with partner housing providers on a rolling schedule (e.g., 50–100 lots per tranche).

SLAs: align inspections, utilities, and right-of-way with service-level agreements to keep the line running.

Incentives: pre-authorize standard incentives (where applicable) tied to price points and delivery.

What we deliver:

One Cell ≈ 500 homes/year at steady state, with Bilt-Blocks OS™ standardizing design → capital → manufacturing → field → buyer pipeline.

Local jobs + training: on-the-job upskilling and crew development inside the Cell.

Monthly throughput reporting: starts, cycle time, cost variance, WIP; quarterly financials.

How A Phased and Practical Approach Doesn’t Overwhelm:

Jump-Start — 35 homes

Prove the lane: finalize permit template, train crews, validate takt time.Standardize — 45 homes

Lock specs, schedules, inspections cadence; cut variance.Repeat — 120 homes

Parallel tracts; stabilize supply and crews.Perfect

From operations, scale to 500 total in the commissioning cycle, then hold ~500/year steady at Cell level.

Result: predictable, non-overwhelming scale-up to an annual production utility inside the “urban donut.”

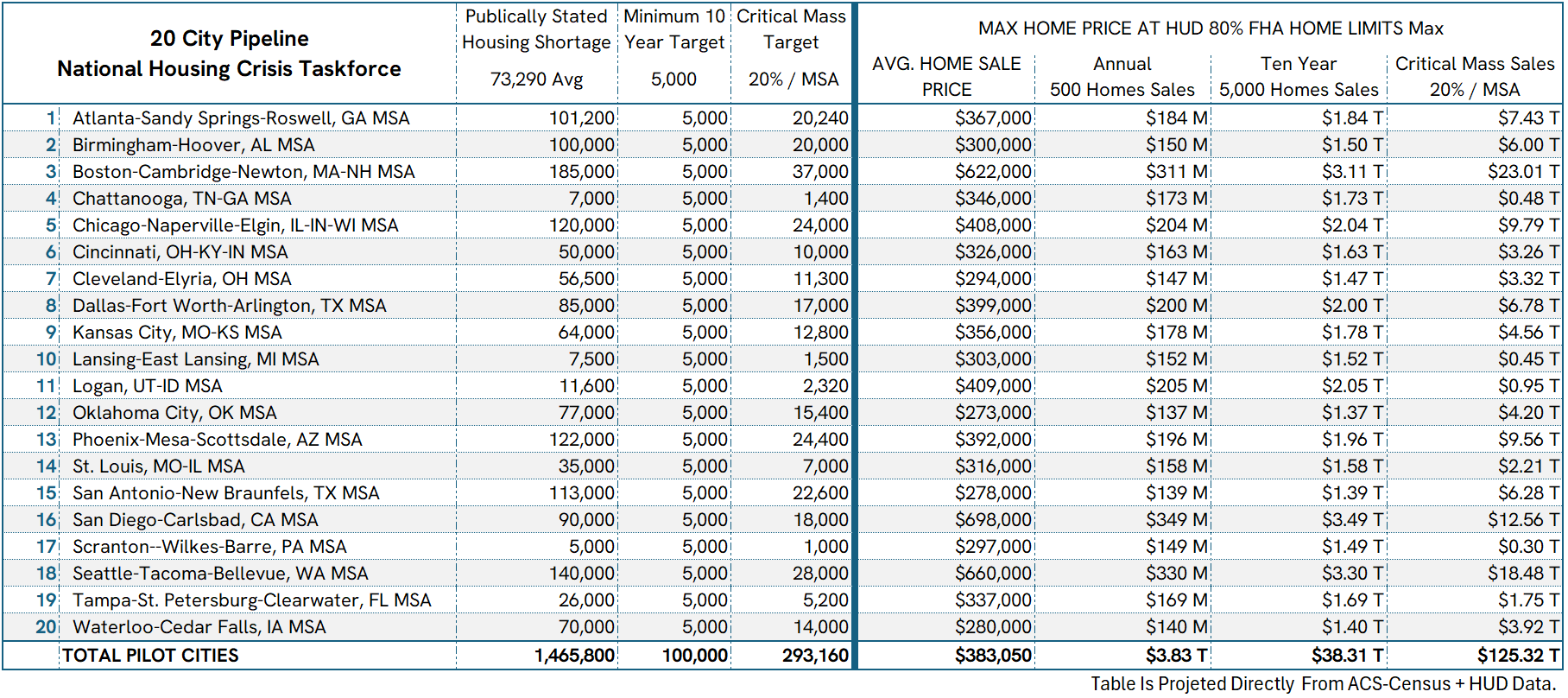

20 City Pipeline Represents 1.46M Families.

Our esteemed advisor Bruce Katz— , former Chief of Staff to the U.S. HUD Secretary and co-founder of the National Housing Crisis Task Force—has been working city-by-city since 2019 to quantify needs, align public tools, and prepare procurement paths. This table aggregates 20 pilot metros that have publicly stated housing gaps and are primed to buy production capacity, not one-off projects.

The model aligns to our foundational thesis: this is an infrastructure play, not a real-estate one; we sell capacity, not projects.

What you’re seeing (high level):

Publicly stated shortage through regional housing studies

20 Cites called for the need of ~1,465,800 homes.

Minimum 10-year commitment (our model): 5,000 homes per city → 100,000 homes across the cohort.

Critical-mass target (planning anchor): ~ 20% of each MSA’s need (the point where a production Cell network materially changes the local market).

Pricing bands: The table uses each metro’s average sale price and HUD 80% FHA cap to show attainable price ceilings and size the procurement, not to set final sales prices (those are tuned locally through Bilt-Blocks OS™).

Why it matters:

These aren’t “maybe” markets. They’re declared needs with public documentation—ideal clients for a Scale-Built Housing™ contract, where the product is guaranteed capacity delivered by a Hub + Cell network. Cities can now procure throughput the way they buy other infrastructure.

How we use it:

The pipeline guides Cell deployment (≈500 homes/year per Cell), permit templates, and site sequencing—so we ramp from Jump-Start → Standardize → Repeat → Perfect without overwhelming city staff or local operators.

It also gives investors a clean way to see where capital scales and how it converts into homes, jobs, and predictable cash flow across multiple metros.

You can explore live Working Housing Scorecards for multiple metros on our site.

Don’t see your city? Reach out and we’ll build a scorecard with your city team—quantifying need, sites, pricing bands, and a staged path to procure capacity (not pilots).

Next Steps

If you’re a city leader:

Let’s draft the capacity contract to meet your outcomes. Greenlight ≥5,000 homes over 10 years.

Let’s co-create the permit template (weeks, not months) and identify a rolling site pipeline.

Set SLAs for inspections/utilities so the line runs without stops.

If you’re an investor:

Pick your lane and request diligence:

Lane A — KC Jumpstart (~$50M): commission the first Cell.

Lane B — Your City: adapt the KC playbook; stand up a local Cell.

Lane C — National Platform ($250M–$1B): activate 5/10/20 Cells.

Read the executive brief: “1,000,000 Homes: A $250M–$1B Raise to Establish a $350B National Housing Infrastructure.”

If you’re a builder or trade partner:

Join the Cell pipeline: standards, schedules, on-time pay, and steady work.

Upskill into lead roles as the Cell stabilizes to ~500 homes/year.

If you’re philanthropy/CDFIs:

Aim capital at system levers (permit standardization, workforce on-ramps, site control) to multiply private investment—beyond pilots.

If you’re an employer or anchor:

Co-sponsor a Cell or tranche to unlock workforce homeownership near job centers.

Why act now + CTAs

The “high-risk” label is really lack of infrastructure.

We’re past theory: $13.9M committed and Kansas City under production.

The 20-city pipeline represents ~1.465M homes of declared need ready to be converted into throughput.

Scale-Built Housing™ turns projects into infrastructure—capacity you can underwrite.

1 - Read the Investment Executive Brief: 1,000,000 Homes: A $250M–$1B Raise to Establish a $350B National Housing Infrastructure

2 - Download the National Housing Infrastructure Investment 11 Page Deck

3 - Book a 20-minute call with Daniel (Daniel@1M.Homes)

4 - See Working Housing Scorecards

(don’t see your city? Reach out and we’ll build one with your team)

Team Summary —

Operators With End-To-End Expertise

OneMillion.Homes Founders – Daniel Edwards & Dr. Ebony Edwards

Architectural engineer + Ph.D. Community Psychologist. Former KCMO Tax Abatement Commissioner (Daniel). Owners of Eastside Lumber (one of the nation’s few Black-owned lumber yards). Built the Scale-Built Housing™ model and Bilt-Blocks OS™; 10,000+ hours in field development and city engagement.

Eastside Lumber — Supply & micro-manufacturing

Certified WBE/MBE. Materials control, pricing leverage, and local workforce training hub. Converts specs into reliable procurement and lowers cost without lowering performance.

BNIM — Design • Planning • Sustainability

Global architecture/urban design firm. Codifies standards, climate metrics, site plans, and permit templates so each Cell is “shovel-ready” in weeks, not months.

4Sight Construction Group — National builder

Veteran-led GC with 9,000+ homes delivered. Field sequencing, QA/QC, safety, and trade mobilization to achieve ~500 homes/year per Cell at predictable cost and schedule.

John McElligott — AI/Robotics/Automation

Integrates cobotics, line balancing, digital twins, and predictive maintenance into Hub + Cell workflows; designs upskilling tracks so local crews run automation.

Bruce Katz — Policy & Capital Strategy

Former Chief of Staff to the U.S. HUD Secretary; co-founder, National Housing Crisis Task Force; Founding Director, Nowak Metro Finance Lab. Leads municipal procurement frameworks, incentive alignment, and public-private capital design.

Strategic finance & ecosystem partners

Closing Statement:

If “high-risk” really means no infrastructure, the cure is simple: build the infrastructure.

That’s what Scale-Built Housing™ is—a system to produce homes, month after month, in the places everyone said couldn’t work.

Let’s turn it on.

Daniel Edwards

OneMillion.Homes

Daniel@1M.Homes