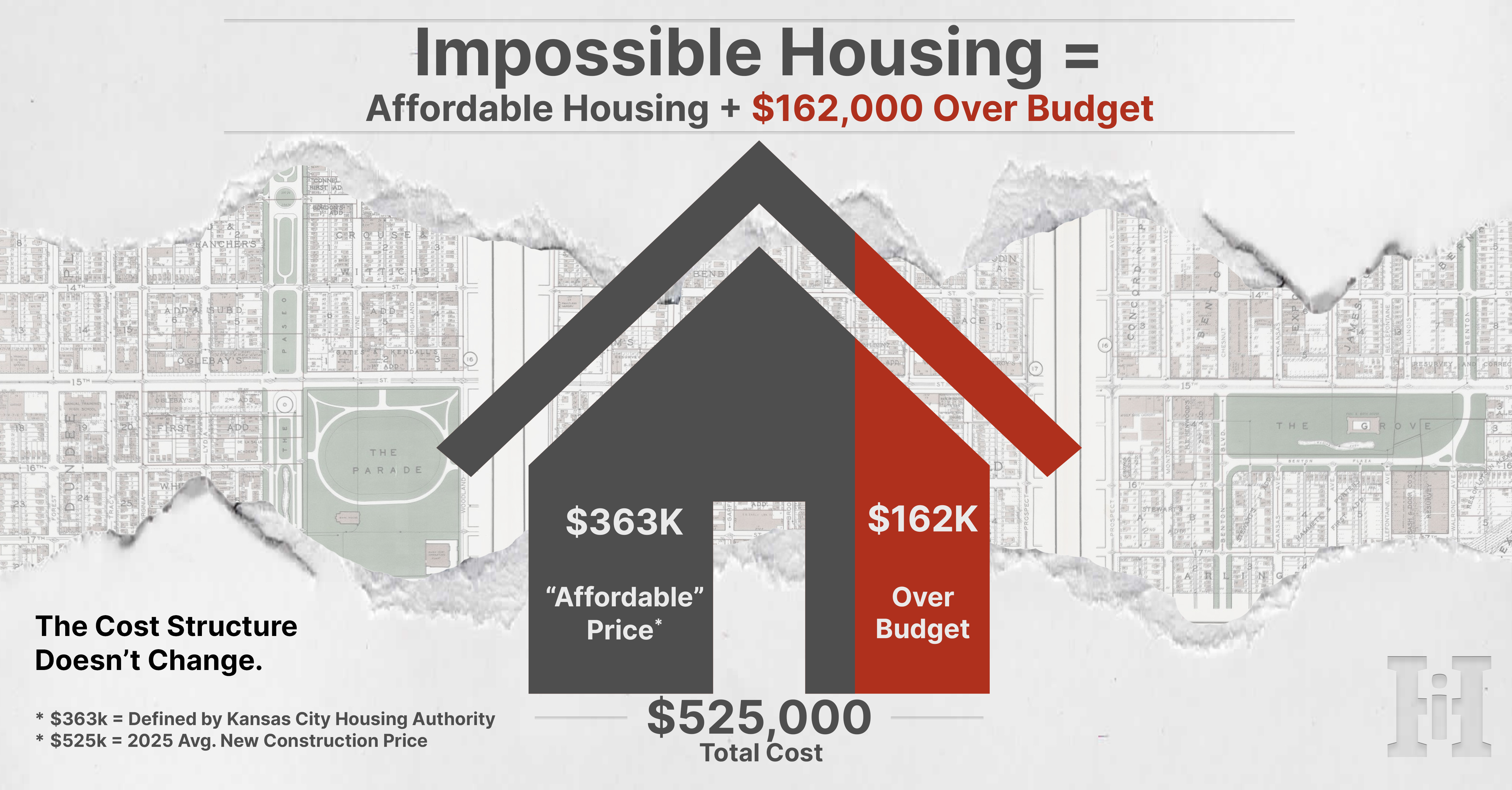

Impossible Housing: Affordable Housing Is $162,000 Over Budget

Affordability is an outcome — not an input.

People say “affordable housing” like it’s a cheaper kind of house.

It’s not.

Think of a $5 meal deal at McDonald’s. After tax, it’s $5.25.

But you only have $3.63 in your pocket.

So you pay $3.63… and grab $1.62 from the coin jar by the register to cover the rest.

That’s “affordable housing.”

Not because the meal got cheaper.

Because someone covered the gap.

THE COST DOESN’T CHANGE:

Here’s the simple version:

A new home costs what it costs to build.

“Affordable” usually just means the buyer can’t pay the full amount.

So the deal needs extra money to bridge the gap.

And this is the part most people miss:

Even nonprofits pay full price.

Nonprofit builder or for-profit builder, it doesn’t matter:

They still hire general contractors.

They still hire laborers, plumbers, electricians.

They still buy lumber, concrete, windows at regular prices.

They still pay permits, inspections, insurance, and all the basics.

“Oh, it’s affordable housing? Cool—50% off.”

says no one

So when you see:

$525,000 total cost

$363,000 “affordable” price

$162,000 over budget

That $162,000 is not a “nice to have.”

It’s the coin jar that makes the math work.

See more on one of our recent notes for what an affordable home should costs

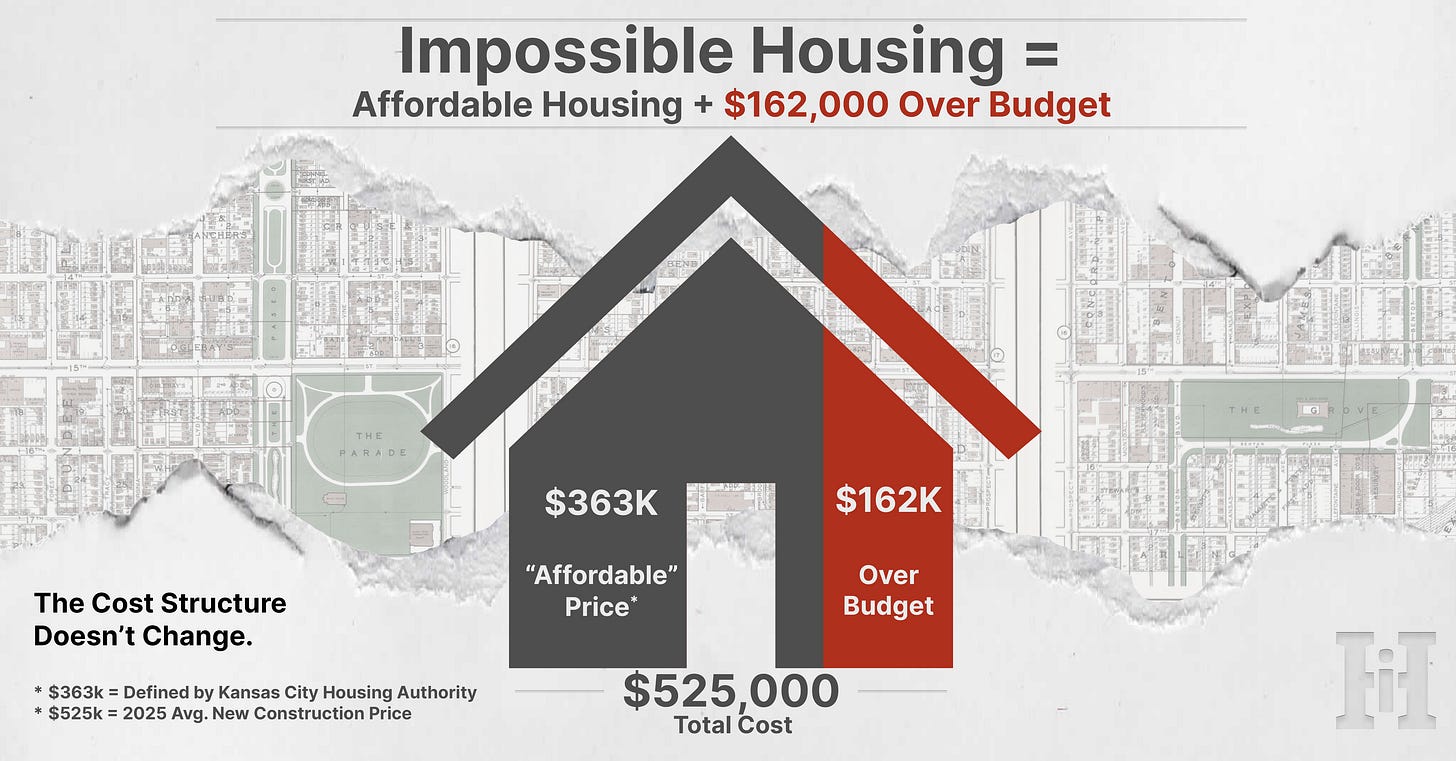

THE GAP AT SCALE… BREAKS TRUST

One home over budget can get done.

But when you try to do this repeatedly, the gap stops being a one-time challenge and becomes the standard way the deal works.

That’s where things get ugly.

1 home over budget is charity.

10 homes over budget becomes capital-intensive (hard to fund, slow to move).

100 homes over budget becomes capital‑prohibitive (too big to realistically cover again and again).

And here’s the real damage this does:

The gap creates distrust inside an established housing industry that has little interest in complexity.

When “over budget” is the normal financing plan,

The whole project feels shaky.

Builders, contractors, and lenders start thinking:

“Is the money actually going to show up?”

“How long is this going to take?”

“What happens if the gap money gets delayed, reduced, or disappears?”

“Are we going to get stuck midstream?”

So fewer people want to touch the work.

That means:

fewer bids

more delays

higher prices

more “urban housing is too risky” stories

And it reinforces the worst belief of all:

“Housing is a bad idea in urban communities.”

Not because it has to be.

Because the model teaches everyone to expect friction, uncertainty, and risk.

A model that relies on the gap cannot scale.

GAP FUNDING = THOUSANDS OF FAMILIES WAITING.

This is where the conversation gets real, fast.

Kansas City, Missouri (Jackson County):

[[North - River, South - 435 Highway, West - Stateline, East 435 Highway]]

The Urban Core

2024: 64 total homes were produced. Habitat for Humanity built 4.

→ 60 of 64 were fully market-rate.As of November 2025: 55 total homes were produced. Habitat built 12.

→ 43 of 55 were fully market-rate.

(KC Home Builder Association Permit Data)

Now zoom out.

Depending on the estimate, Kansas City is short anywhere from ~12,000 to 24,000 homes just to meet current resident demand. At the same time, tens of thousands of Kansas Citians (roughly 60,000–64,000) are already paying too much of their income just to stay housed. (MARC Kansas City)

And cherry on the top - 16,500 Families earn enough to be able to buy a house, but we only produce a handful of homes a year as an over core. (KCMO Cost Burdened Families)

SEE MORE HERE about The [Urban Core] Housing Donut Dilemma

So whether it’s 4 homes, 12 homes, or even a few hundred homes a year… that’s still tiny compared to a shortage measured in tens of thousands.

That’s not a production engine.

That’s not a pipeline.

That’s a warning light.

If the only way to create “affordable” homeownership is a gap that has to be refilled every single time, you’ll keep getting the same output: small numbers, slow growth, and an industry that doesn’t trust the model.

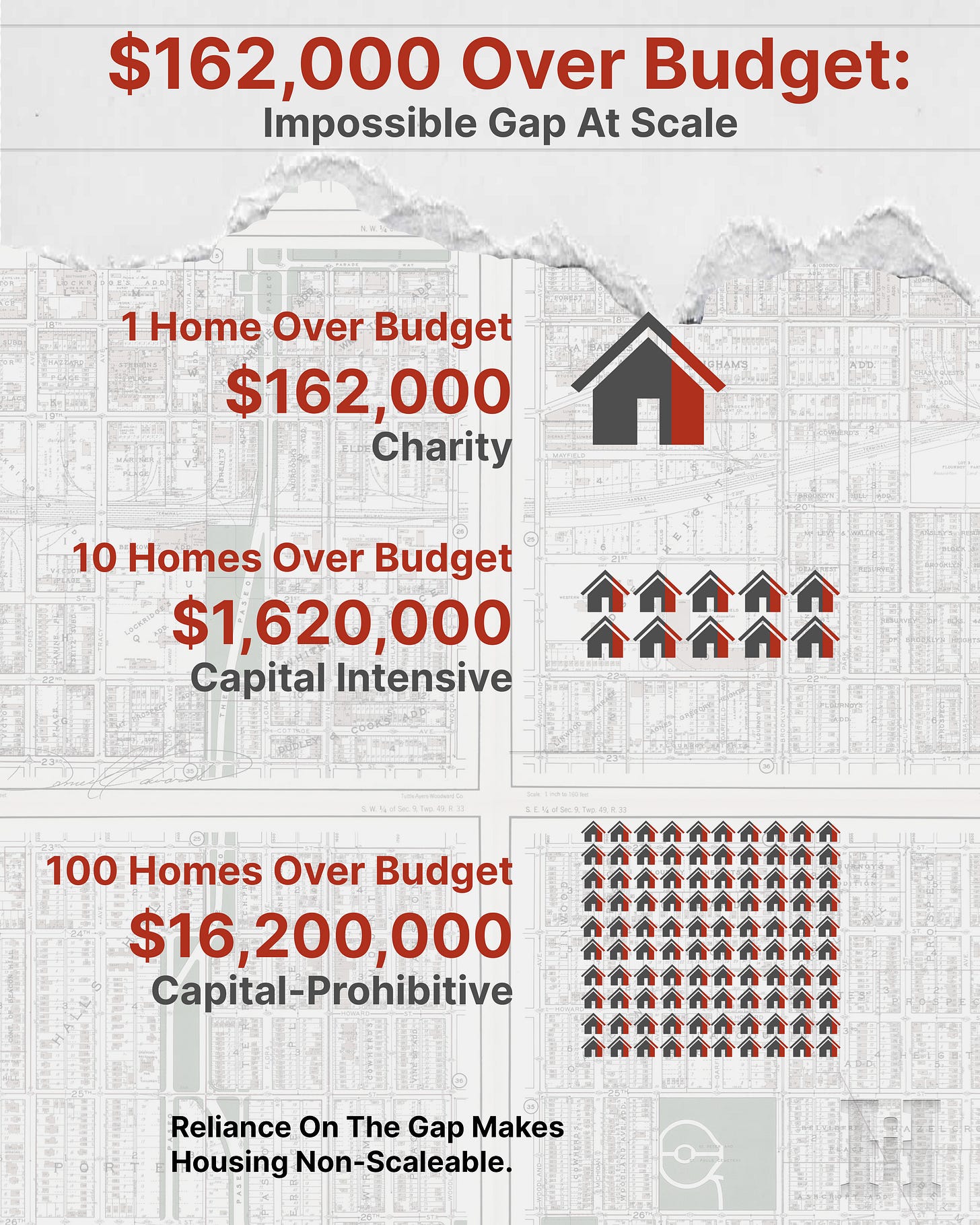

THE UNLOCK IS CREATING A NEW BUSINESS MODEL.

If the gap model can’t scale, we need a different approach:

Not “How do we find more coin jars?”

But “How do we make homes cheaper to produce?”

This is the shift:

Project Model (Fragmentation) — $500K+

One-off builds.

Each home is a custom effort.

Affordability requires subsidy.

Production Model (Standardization) — $400K+

Standard plans.

Repeatable crews.

Faster build times.

More homes per dollar.

Industry Model (Scale) — $300K+

Continuous production.

Economies of scale.

Naturally attainable homes.

That’s the throughline:

Home cost drops when the business model changes.

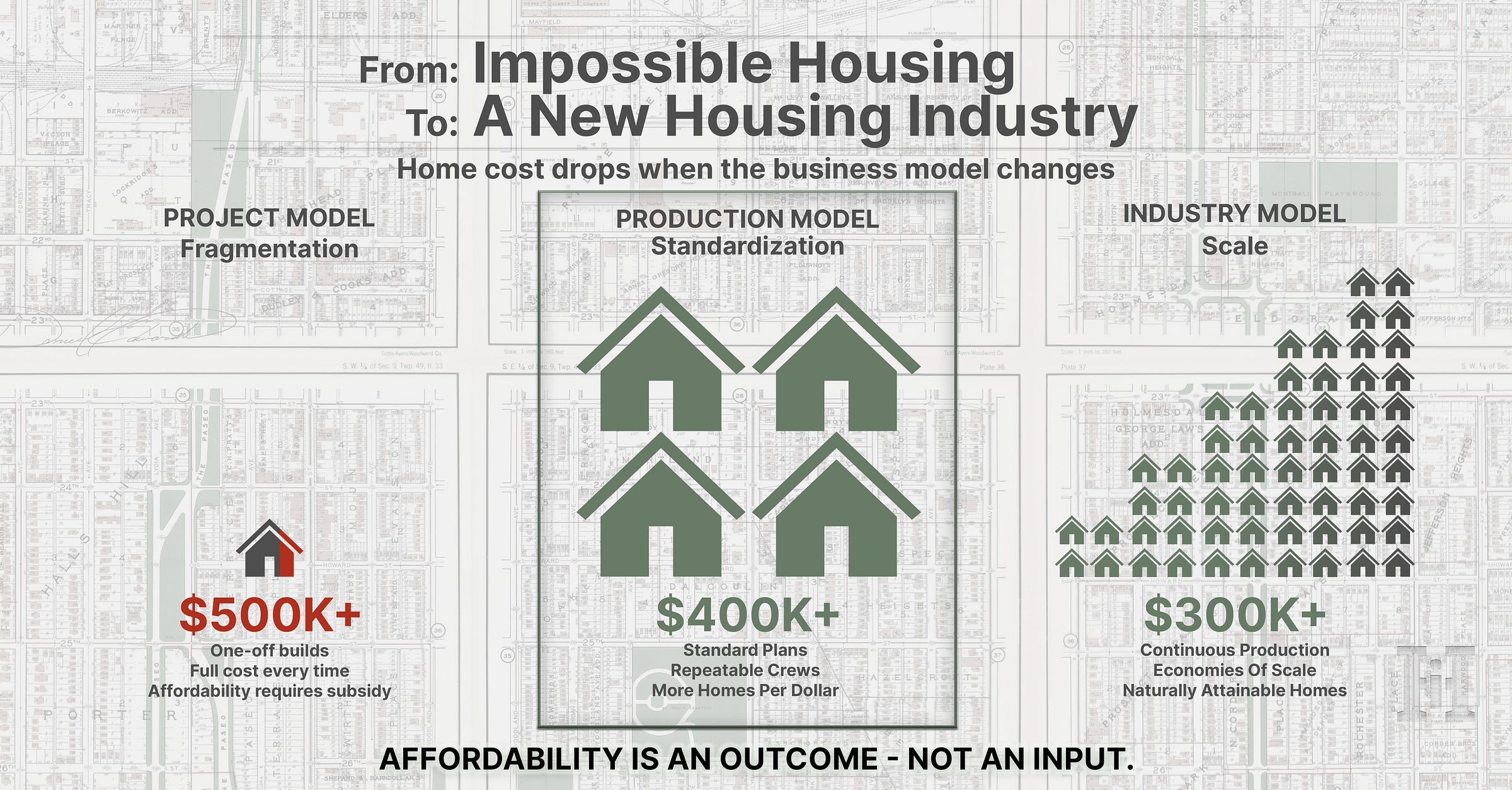

STOP USING THE $162K TO FUND THE GAP.

START INVESTING TO CREATE PRODUCTION.

Right now, we keep using ~$162,000 to “fix” one home after it’s already expensive.

That is patchwork.

So here’s the contrast:

Stop doing this

Use $162,000 to close the gap on 1 home.

Then repeat the problem again.

And again.

And again.

Start doing this

Use that same ~$162,000 as upfront investment—not a bailout.

If instead we treat it like production money, roughly $40,000 per home, to pay for things that make housing repeatable—like:

standard plans and repeatable designs

process that cuts delays

repeatable crews and predictable work

upfront help (like closing costs) that keeps deals moving

Then:

~$160K can help produce ~4 homes (instead of discounting 1)

~$1.6M can help produce ~40 homes (instead of discounting 10)

~$16M can help produce ~400 homes (instead of discounting 100)

That’s the punchline:

Stop paying to “make one home affordable.”

Start investing to make “homes” attainable.

THE LINE TO REMEMBER

Affordability is an outcome — not an input.

So the next time you hear about an “affordable housing” project, don’t just clap because the press release sounds good.

Use the announcement like a scorecard. Ask three questions:

Where is the gap money coming from?

If the deal only works because someone is covering a big missing amount per home, it’s probably more of the same.Does this make the next project easier to build—or does it need a brand-new fundraising effort again?

If it requires new “coin jar” money every time, it won’t scale.What part of this actually lowers the cost to produce homes?

Standard plans, repeatable crews, faster timelines, predictable process—these are signals of a new housing industry.

CTA: LET’S TALK IT THROUGH

If you hear “affordable housing” language that sounds polished but feels like it’s hiding the real math, send it to me.

I’ll break it down,

Explain what it actually means,

And share it so more people can tell the difference between real innovation and more of the same.