1,000,000 Homes: A $250M–$1B Raise to Establish a $350B National Housing Infrastructure | Part 1

Activating 5 - 20 US Cities In Our Pipeline. $13.9M Committed; Kansas City, MO under production.

[5 Minute Read]

CTA: Download Our National Housing Infrastructure Investment Deck - And Book A 20 minute call with Daniel at your convivence:

[ Read Part 2 - Long Form Narrative — 1,000,000 Homes: A New National Housing Infrastructure | Part 2 ]

Thanks for reading OneMillion.Homes! This post is public so feel free to share it.

RADICAL + PRACTICAL

Since 2019, we’ve been on the road meeting with cities about one problem:

How can we help turn on housing production where it never happens?

Heading into the 2024 Election, housing was a headline platform:

Calling for the construction of 3,000,000 new homes.

Tax incentives for business that build housing.

Down payment assistance for new home buyers.

Election Morning - Nov. 5, 2024 - We believed we were perfectly positioned.

The morning after election, all housing conversations immediately stopped.

I was in the room with my Boston Impact Initiative fund-manager cohort that morning, reviewing funding plans. The shared concern was blunt: the election could further stall urban housing production.

Inside, I felt the reminder: this is why I’m here. This is why we became fund managers—to raise capital and build a platform we can control, regardless of who is in office. It was never about who wins an election; it’s about creating a system that makes production inevitable.

So I made a statement to the group:

We will build the platform and raise the fund

to produce 1,000,000 homes in the next ten years

in cities with housing crisis.

It sounded radical then. It still feels crazy to imagine today.

But 365 days later and after seeing declining production in city centers…

Radical has become the only practical solution.

And it’s a $350B investment opportunity hiding in plain sight.

We backed the words with execution: we’ve secured $13.9M in commitments and are already under production in Kansas City.

The plan is no longer theory. It’s a system you can underwrite.

Our innovation isn’t a shiny new object. This Is Not 3D-printed headlines or a mega-modular factories built by tech tourist.

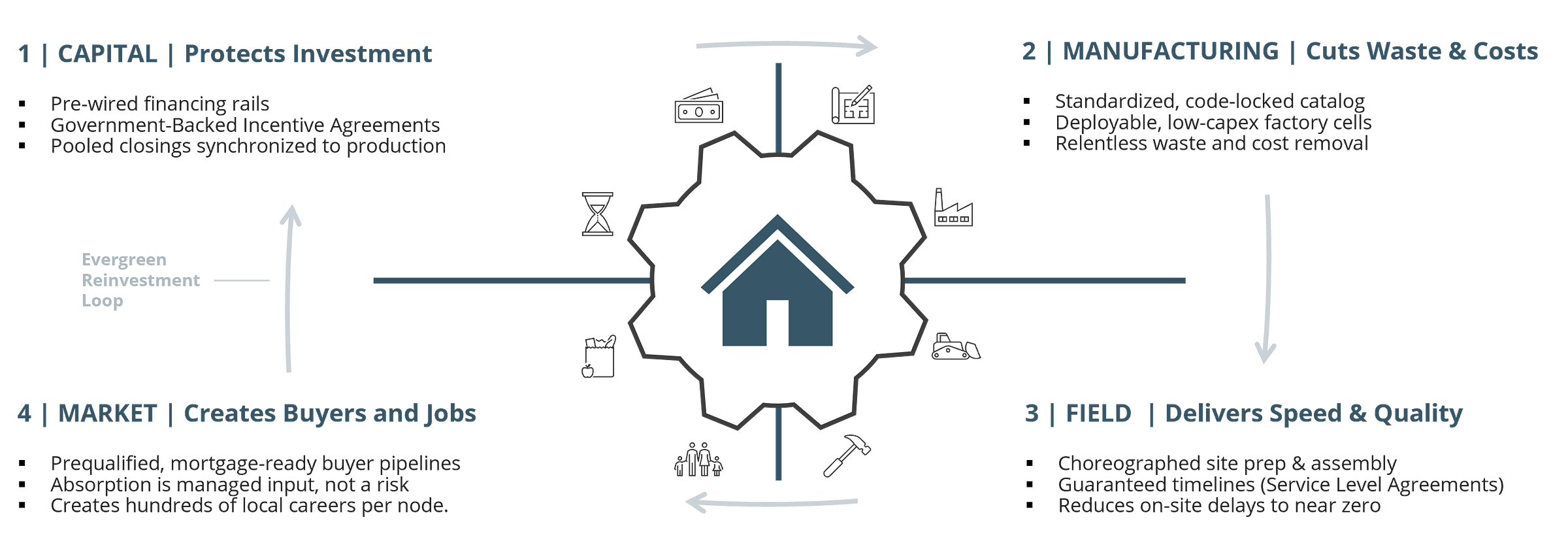

It’s the disciplined integration of proven parts across the value chain into one coordinated business model that ends fragmentation and removes the bottlenecks that paralyze urban housing production.

Investment Summary To Activate 5 - 20 Cities

Category: Scale-Built Housing™ = Housing production as infrastructure

Client: Municipalities that need a production system, not one-off projects.

Municipal commitment: A resolution/MOU to greenlight a minimum of 5,000 homes over 10 years (capacity contract).

Unit of Growth: Cell ≈ 500 homes/year, replicated city by city.

System: Bilt-Blocks OS™ + Hub + Cell; permit templates compress approvals weeks vs months.

KC In Production: First 500 Homes, $13.9M committed.

KC impact (baseline): 16,500 homes. ~$5.7B total economic impact, ~33,000 careers over 10 years, within 10 minutes of downtown.

Pipeline: 20 cities, ~1.465M homes stated need (National Housing Crisis Task Force)

Investment Ask: Choose a lane (A/B/C) and schedule diligence.

Investment Ask (3 lanes)

Lane A — KC Jumpstart: ~$50M (≈$10M Cell capex + ≈$40M working capital). Commission the first Cell; run parallel tracts; lock the playbook.

Lane B — Your City, Copy-Pasted: Adapt the KC model to your city; stand up a local Cell; co-invest options for local anchors.

Lane C — National Platform: $250M / $500M / $1B to activate 5 / 10 / 20 Cells across the pipeline.

Team

Daniel & Dr. Ebony Edwards — Founders; Eastside Lumber owners; Together.Homes & Neighborbuilt.

BNIM — Design/planning, climate standards, permit templates.

4Sight Construction — 9,000+ homes delivered; sequencing + QA/QC.

John McElligott — AI/robotics/cobotics, line balancing, predictive maintenance.

Bruce Katz — Policy & capital strategy; former HUD Chief of Staff; co-founder, National Housing Crisis Task Force.

Links To Post 2 for BIOs

Risk → Mitigation

Execution across cities → KC first, replicate OS.

Cost/schedule → Hub + Cell, takt planning, QA/QC.

Absorption → Mortgage-ready workforce; managed pipeline.

Capital stack → Growth-capital with incentives layered; milestone funding.

Economics

Preferred 8%, target net IRR 15–25%+ by lane/city;

quarterly reporting;

IP/playbook scale.

CTAs

Request diligence access & model walkthrough (Daniel@1M.Homes)

Choose your lane (A/B/C) → we’ll return draft terms + timeline

Regulatory note: This communication is for informational purposes only and is not an offer to sell or a solicitation of an offer to buy any security. Any offering will be made only to qualified investors via formal materials.

Thanks for reading OneMillion.Homes! Subscribe for free to receive new posts and support our work.